AnnaStills/Getty Images

- A stock screener is a search tool that helps investors sift through and find stocks that meet certain requirements they set.

- Stock screeners allow investors to search and find stocks based on market cap, P/E ratio, and much more.

- Not every stock screener is the same and some require payment for more advanced features.

- Visit Insider's Investing Reference library for more stories.

What you choose to invest in ultimately determines your overall returns in the stock market and can be the difference between gains and losses. So having the tools necessary to both find and analyze the various stock options available to you is key.

But with nearly 8,000 different stocks to choose from between the New York Stock Exchange and the Nasdaq, how can investors quickly identify stocks that have the potential to grow without being overwhelmed by the number of options? This is where a stock screener can become a very useful tool.

What is a stock screener?

A stock screener is a search tool that allows an investor to search and sort through stocks that meet criteria the investor is looking for. Put another way, a stock screener is to an investor what Google is to the internet.

"Screeners are great for narrowing your list of potential stocks to invest in," says Joseph Hogue, CFA, former venture capital analyst and blogger at My Stock Market Basics. "There are more than 3,000 stocks traded on the NYSE alone so it helps to narrow the list by filtering out those that might not make for a good investment."

Many stock screeners are free for the most basic features and may include a paid option for more advanced functionalities. Some of the most popular stock screeners are independent websites, but some brokerages also include a stock screening feature as well.

How do stock screeners work?

A stock screener works by compiling a list of stocks and begins to filter them out as you include your selection criteria. Once you've finished entering your desired traits, the stocks remaining on the list are those that fit your targets.

You can then use those remaining stocks to make investing decisions or continue researching to determine which of the remaining stocks will ultimately help you meet your goals. Investors tend to use stock screeners for different reasons. Some investors have a specific strategy that they like to follow. Stock screeners can help them save time and quickly identify the stocks that may be best for that strategy.

For example, if you're an investor who wants to buy only dividend stocks priced above $20 per share, a stock screener can quickly generate a list of suitable options to choose from. A screener can also help to narrow down further and search for companies within a certain sector of the market like financial services, energy, or hotels.

Stock screeners may also help investors cut out some of the noise around a particular stock. This is because a screener is looking for stock types and doesn't directly account for recent news or investor sentiment that may cloud a sound investing decision.

But stock screeners are not perfect. "The biggest drawback to stock screeners is they can't tell you which one stock to invest in. Screeners are very good at narrowing down your list to a few handfuls that meet criteria, but you'll still need to do a little research to find the best few to buy," adds Hogue.

Stock screener example

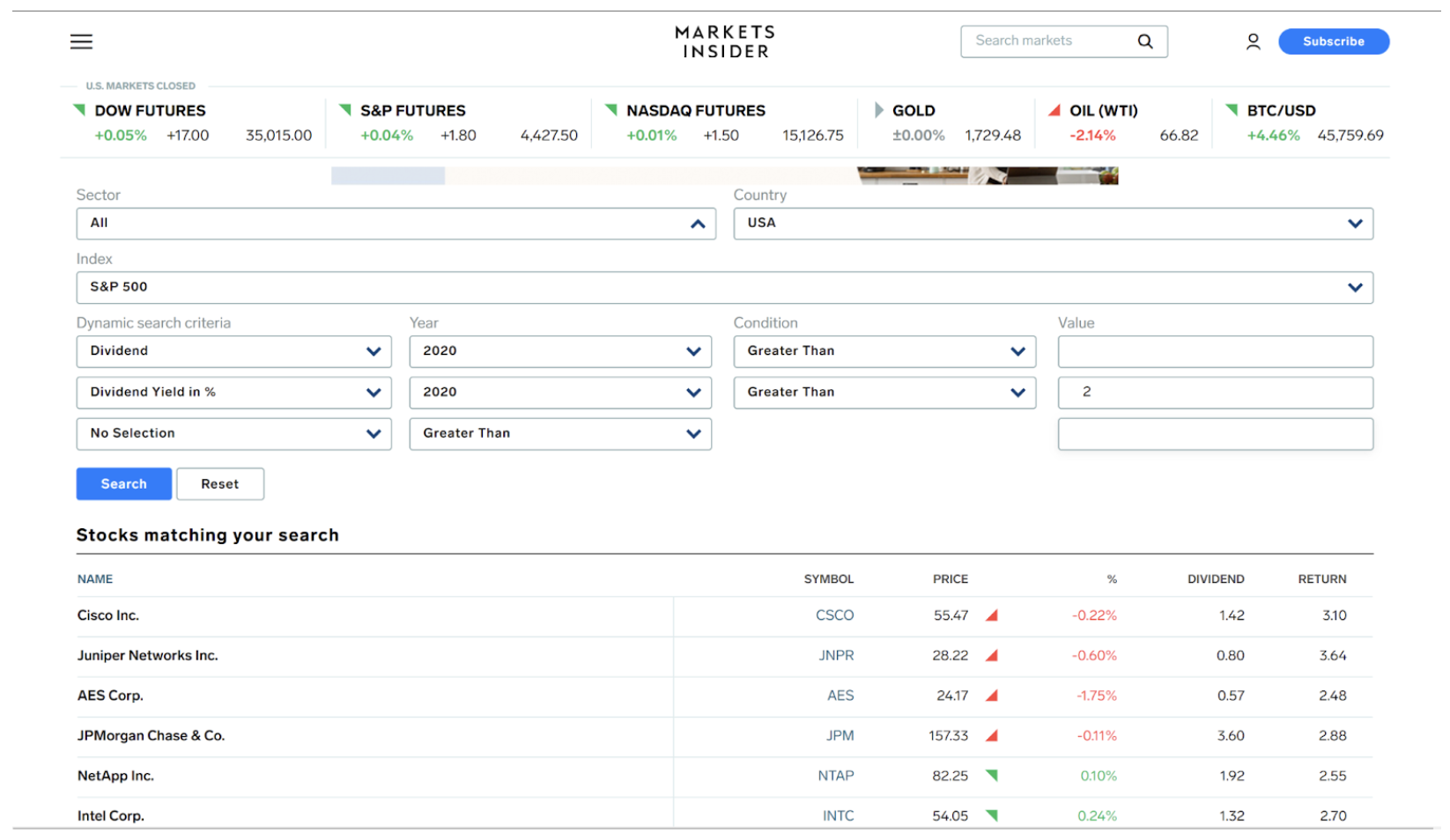

Let's walk through an example using the free stock screener from Markets Insider. Let's say you're an investor who's looking for dividend-paying stocks based in the US. Dividends are payments made by a company to its shareholders.

First, start by selecting the country as "USA." Next is the index section - an index measures the performance of a group of individual stocks. For this example, we'll use the S&P 500, which represents the 500 largest companies in the US. If you're following along, you'll see that these two selections have already narrowed down the list to large companies in the US after you've hit the blue search button. But by using other factors we can trim our list down a bit more.

Using the "dynamic search criteria" section, select dividend in the first drop-down menu and then select dividend yield % for the second drop-down, both for the year 2020. Dividend yield shows how much a company pays its shareholders in dividends compared to its share price. It's a ratio that's expressed as a percentage.

Generally, a dividend ratio between 2% and 6% is considered good. For this example, across from the dividend yield we will select greater than 2% and hit the search button again. You should see more than seven pages of stocks that all fit our criteria. (Keep in mind that your results may differ based on the current market's price.)

Markets Insider

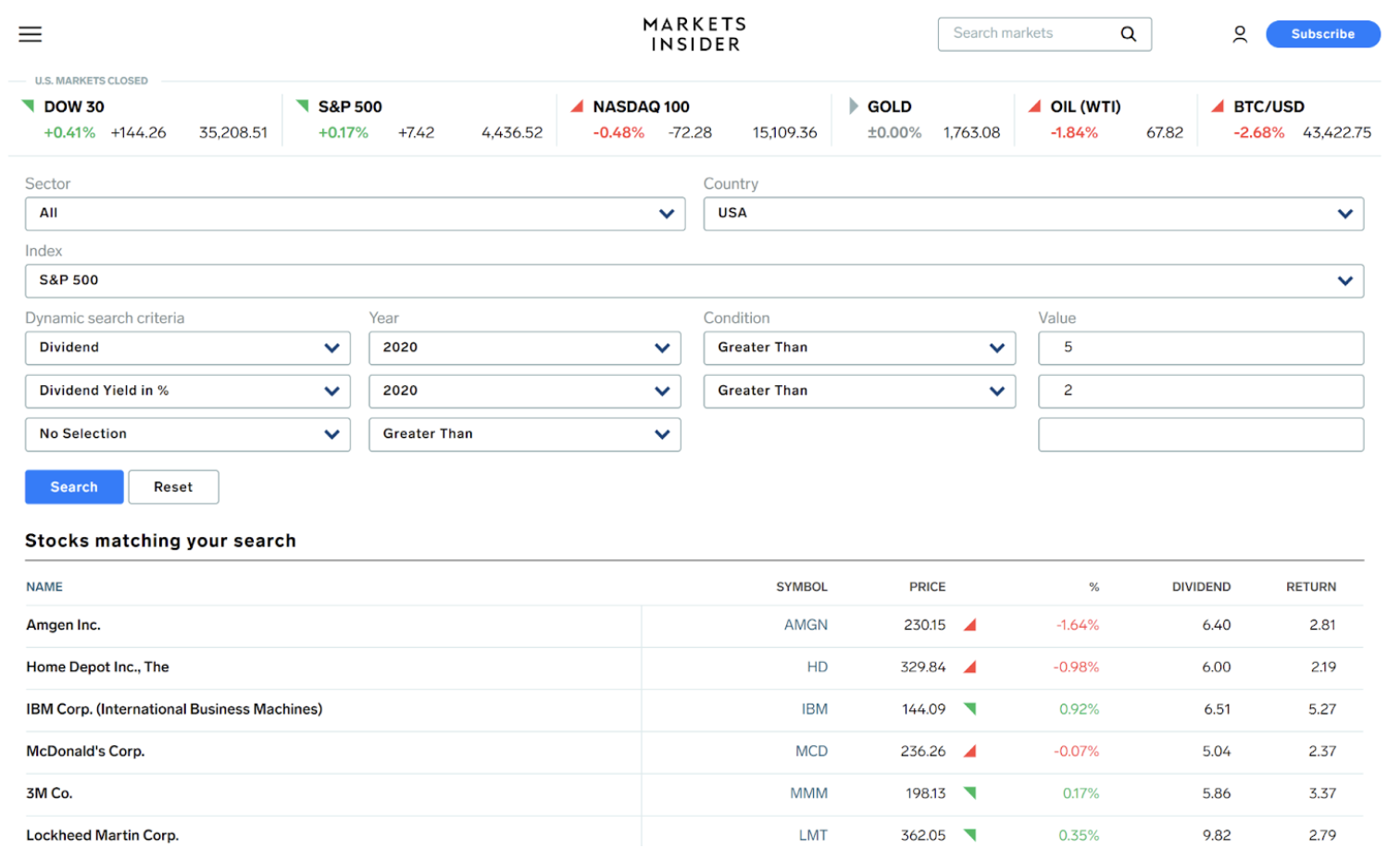

Let's narrow down a bit further: Now in the dividend row, enter greater than $5. This will provide a list of companies in the S&P 500 that pay a greater than $5 dividend with a greater than 2% divided yield. With these selections you should see just one page of results which should be more manageable.

Markets Insider

Which screening criteria is the best? That's going to depend on your individual goals and your investing strategy. Fundamental investors may screen for companies using P/E ratio, earnings per share and strong cash flows to determine which stocks to buy.

While technical investors are more focused on price action and might screen for companies that are traded with a certain volume or its performance against a moving average. Whether you lean more to the fundamental side or technical, a stock screener can still help you quickly identify a list of suitable stocks to invest in based on your selections.

The financial takeaway

Stock screeners make it simple to curate thousands of stocks based on your specific criteria. Before attempting to find the perfect stock screener, it's important to take a moment and define your investing goals and strategy. With a firm foundation on those two elements, you can better assess what type of features you might need for a screener.

But you shouldn't rely on any stock screener blindly. "Even if you narrow the list down to a few stocks, don't just blindly invest in each just because they met a few criteria. Always spend a little more time researching the stock to make sure the company is a good investment," says Hogue.